Erik Torenberg:

Erik Torenberg:⌚️ Time required: 30 minutes.

There's the money crypto camp, the tech crypto camp, and the camp for people who don't believe in the money/tech crypto camp paradigm.

💸 Money Crypto vs Tech Crypto by  Erik Torenberg:

Erik Torenberg:

Money Crypto believes that censorship resistant store of wealth is paramount. This may seem strange to us living in the U.S., where we trust our banks and governments (for now!), but much of the world doesn’t have that luxury: People suffer from corrupt governments, currency controls preventing people from covering capital, and currency inflation due to government instability.

Tech Crypto believes that the internet will only have increasingly more of a say in how power and wealth is distributed, and fixing the incentives (via cryptonetworks) is one of the most important things we can do, along with enabling consumers to own and control their own data.

source: Token Daily

👀 Neither Crypto by  Fred Wilson:

Fred Wilson:

There is a narrative in crypto land that you are either in the “crypto is money” camp or the “crypto is tech” camp.

Brian Armstrong, founder and CEO of our portfolio company Coinbase, was interviewed by Fitz Tepper.

Fitz asked Brian “are you a tech company or a finance company.”

I like how Brian acknowledges that framework but ultimately concludes that the answer is neither, that Coinbase is a crypto company and that crypto is both tech and money.

I am of that view as well and I am glad to see leaders in the crypto sector articulating it.

source: AVC

One of the things that is most exciting about the crypto ecosystem is the ability for anyone to build on anyone else's work. Here is a clip where  Deiter, the CTO of Dapper Labs / Cryptokitties talks about how other developers build new games on top of Cryptokitties without the Cryptokitties team granting access or being a gatekeeper. Watch from 3:00 until 5:25.

Deiter, the CTO of Dapper Labs / Cryptokitties talks about how other developers build new games on top of Cryptokitties without the Cryptokitties team granting access or being a gatekeeper. Watch from 3:00 until 5:25.

This is kind of the dream. In the past, the inability for people to easily build on each other's work was seen as a big deterring factor to innovation:

Perhaps the central problem we face in all of computer science is how we are to get to the situation where we build on top of the work of others rather than redoing so much of it in a trivially different way. Science is supposed to be cumulative, not almost endless duplication of the same kind of things.

One more interesting thought on openness of crypto platforms. Listen to  Chris and

Chris and  Fred from 41:30 - 42:54:

Fred from 41:30 - 42:54:

In different systems there are different scarce resources. First, listen to this 90 second clip where  Alex Danco talks about the scarcity in paradigms before cryptonetworks. Listen from 38:34 - 40:05:

Alex Danco talks about the scarcity in paradigms before cryptonetworks. Listen from 38:34 - 40:05:

Below are some guiding question with some starting ideas that you should use to deepen your understanding of the topic.

So what's the scarce resource in cryptonetworks? One possibility is that the scarce resource in cryptonetworks is hashrate. Developers and users would opt to build on a network with the most access to hashrate and even play a premium for it in token price, because that is the scarce thing that secures the network.

This idea is played out in a theory called the Fat Protocol thesis by  Joel Monegro which explains that the value (the scarce resource, hashrate) is in the cryptonetwork, not the overlaying dapps. This is different from in the web, where value accrues in the user facing end applications (think Facebook, Amazon, Google - the biggest tech giants are end user apps).

Joel Monegro which explains that the value (the scarce resource, hashrate) is in the cryptonetwork, not the overlaying dapps. This is different from in the web, where value accrues in the user facing end applications (think Facebook, Amazon, Google - the biggest tech giants are end user apps).

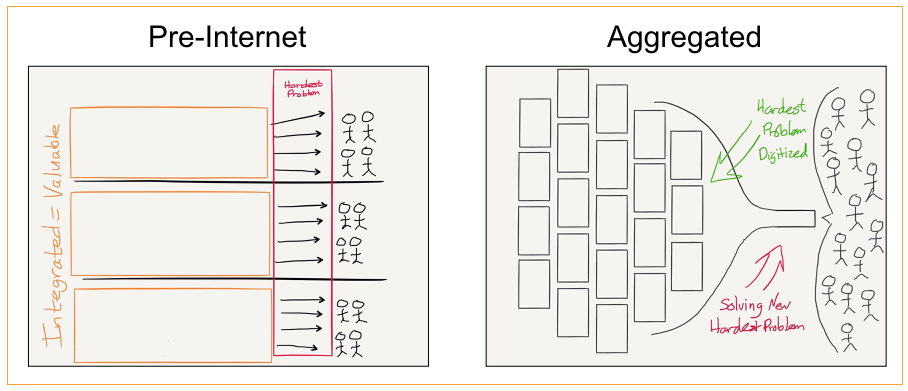

The previous generation of shared protocols (TCP/IP, HTTP, SMTP, etc.) produced immeasurable amounts of value, but most of it got captured and re-aggregated on top at the applications layer, largely in the form of data (think Google, Facebook and so on). The Internet stack, in terms of how value is distributed, is composed of "thin" protocols and "fat" applications.

This relationship between protocols and applications is reversed in the blockchain application stack. Value concentrates at the shared protocol layer and only a fraction of that value is distributed along at the applications layer. It's a stack with "fat" protocols and "thin" applications.

There are two things about most blockchain-based protocols that cause this to happen: the first is the shared data layer, and the second is the introduction cryptographic “access” token.

source: Joel Monegro

Tokens are reason value accrues in the protocol layer of cryptonetworks - they for the first time let someone invest directly in the protocol layer, which wasn't possible before with HTTP, TCP, etc. The thing that is new and interesting about tokens is that they are somewhere in-between using a network and investing in the network. Hear  Fred Wilson describe it, listen to 30:27 - 32:34:

Fred Wilson describe it, listen to 30:27 - 32:34:

There's a question of how much a token should be valued at in any network.  Chris Burniske has a guideline framework:

Chris Burniske has a guideline framework:

Within its native protocol a cryptoasset serves as a means of exchange, store of value, and unit of account. By definition, then, each cryptoasset serves as a currency in the protocol economy it supports. Since the equation of exchange is used to understand the flow of money needed to support an economy, it becomes a cornerstone to cryptoasset valuations.

The equation of exchange is MV = PQ, and when applied to crypto my interpretation is:

M = size of the asset base

V = velocity of the asset

P = price of the digital resource being provisioned

Q = quantity of the digital resource being provisioned

A cryptoasset valuation is largely comprised of solving for M, where M = PQ / V. M is the size of the monetary base necessary to support a cryptoeconomy of size PQ, at velocity V.

source: Chris Burniske

Aggregation theory argues that an internet application with a lot of users can continue to aggregate functionality, minimizing competition.

source: Stratechery

The idea in Fat Protocol thesis is that the value accrues in the shared data layer of the network, and that users can freely move between apps because they all surface the same underlying data. (Think of apps like Twitter clients. Users can move between them easily because they all curate the same tweets).

Aggregation Theory would argue that no - once an end user app had enough eyeballs, it would fork the network or start adding proprietary data to retain its users. This is like how Netflix started by being an interface showing open TV data, and once it had enough eyeballs, it started creating original content, locking in users to Netflix.

This is well explained by  Kyle Samani at Multicoin Capital:

Kyle Samani at Multicoin Capital:

I’ll propose a thought experiment in which a dapp steals value from the protocol that its built on.

Augur is comprised of two parts: the protocol (the smart contracts on the Ethereum blockchain) and the end-user application. Anyone can hook up any user experience (UX) to the Augur protocol.

AugurCo controls the UX. Therefore, AugurCo can choose which markets to show in its UI. Naturally, AugurCo will create markets itself, and not show markets created by third parties.

So long as AugurCo has sufficient scale and ability to resist censorship, the only rational thing to do is to fork the Augur protocol.

If an AugurCo is going to fork Augur, why even bother with decentralization at all? Why leave 25% or 50% of revenues for a decentralized network of reporters? Why doesn’t AugurCo just recentralize the whole thing and collect 100% of the fees for itself? I suspect some AugurCos will try this at some point.

source: Multicoin Capital

The other thing we can take away from hashrate being the scarce resource in cryptonetworks is that whichever network has the most efficient means of producing the scarce resource (hashrate) would win. This is one reaosn why there is a huge amount of focus on developing more efficient consensus protocols.

The last thing to talk about is how do these cryptonetworks evolve over time? Here is an interesting view by  Andreas Antonopoulos of how products in the crypto sphere will develop. Watch from the beginning to 7:35 then skip to 21:11 and watch until 22:48. (This is a good one to watch on 2x speed).

Andreas Antonopoulos of how products in the crypto sphere will develop. Watch from the beginning to 7:35 then skip to 21:11 and watch until 22:48. (This is a good one to watch on 2x speed).

The main takeaway here is that development will happen in iterative apps, then infrastructure, then apps again, then infratsructure again cycles. The following is by  Nick Grossman and

Nick Grossman and  me

me

Platforms evolve from an iterative cycle of apps=>infrastructure=>apps=>infrastructure and are rarely built in an outside vacuum.

First, apps inspire infrastructure. Then that infrastructure enables new apps.

What we see in the sequence of events of major platform shifts is that first there is a breakout app, and then that breakout app inspires a phase where we build infrastructure that makes it easier to build similar apps, and infrastructure that allows the broad consumer adoption of those apps. Kind of like this:

Apps and infrastructure evolve in responsive cycles, not distinct, separate phases.

source: USV